Debt recycling is a financial strategy that can help individuals on their journey to wealth creation. By understanding the concept of debt recycling and its role in wealth creation, as well as the mechanics and financial implications, one can effectively implement this strategy while maintaining financial discipline and navigating the legal and tax implications. This article will provide a comprehensive guide to the essentials of a debt recycling strategy.

Understanding the Concept of Debt Recycling

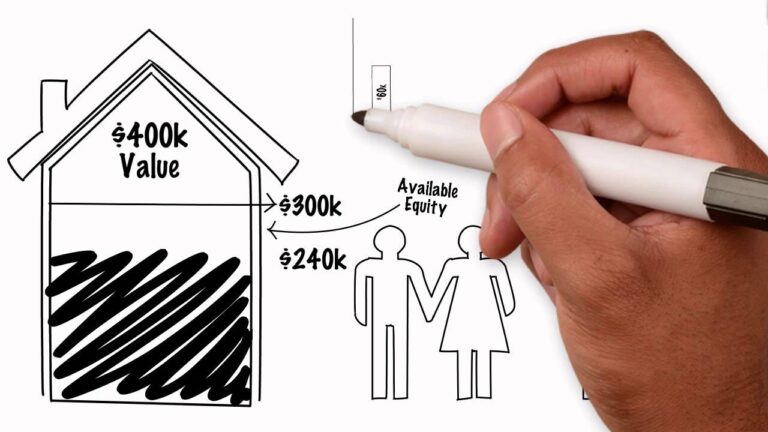

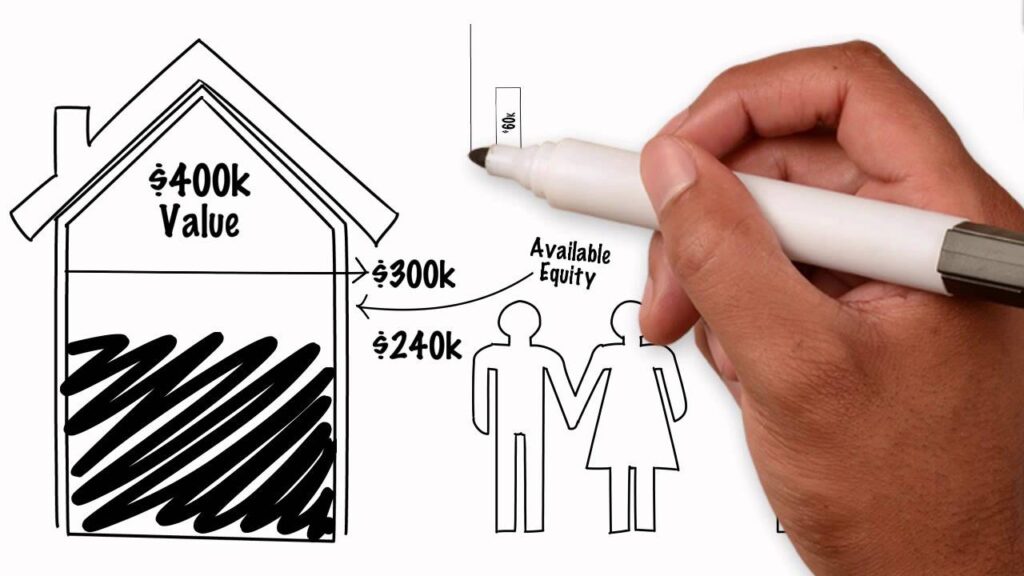

Debt recycling is a powerful financial strategy that allows individuals to transform non-tax-deductible debt with wealth accumulation plans suggested by financial advisor Sydney, such as a mortgage, into tax-deductible debt by redirecting cash flows. This innovative approach involves borrowing against the equity in your property to invest in income-producing assets, while using the income generated to reduce your non-tax-deductible debt.

But how exactly does debt recycling work? Let’s dive deeper into the process.

The Basics of Debt Recycling

Before embarking on a debt recycling journey, it is crucial to assess your current financial situation. This involves evaluating your mortgage, other debts, and existing investments. By gaining a comprehensive understanding of your financial standing, you can develop an effective debt recycling plan tailored to your specific needs and goals.

Once you have assessed your situation, the next step is to identify potential income-producing assets to invest in. These assets can range from shares and investment properties to managed funds. However, it is important to note that careful research and professional advice are essential to ensure you make informed investment decisions that align with your risk tolerance and financial objectives.

By strategically redirecting cash flows from your income-producing assets, you can accelerate the repayment of your non-tax-deductible debt. This not only reduces the burden of your debt but also helps you build an investment portfolio that generates a passive income stream.

The Role of Debt Recycling in Wealth Creation

Debt recycling plays a crucial role in wealth creation by leveraging your existing assets to generate additional income. The income generated from your investments can be used to further reduce your non-tax-deductible debt or reinvested to expand your investment portfolio. This compounding effect can significantly contribute to your long-term wealth accumulation.

Moreover, debt recycling allows you to take advantage of tax deductions on the interest paid on your investment loans. This can result in substantial tax savings, further enhancing the overall financial benefits of this strategy.

It is important to note that debt recycling is not a one-size-fits-all approach. The success of this strategy depends on various factors, including your financial goals, risk tolerance, and market conditions. Therefore, seeking guidance from a qualified financial advisor is crucial to ensure that debt recycling aligns with your unique circumstances.

In conclusion, debt recycling is a powerful financial strategy that can help you transform non-tax-deductible debt into tax-deductible debt while simultaneously building an investment portfolio. By strategically redirecting cash flows and leveraging your existing assets, you can accelerate your journey towards financial freedom and long-term wealth accumulation.

The Mechanics of a Debt Recycling Strategy

Implementing a debt recycling strategy requires careful planning and execution. By following these steps, you can effectively navigate the journey to wealth creation:

Debt recycling is a financial strategy that involves leveraging the equity in your property to invest in income-producing assets. This approach aims to accelerate wealth creation by using borrowed funds to generate additional income and reduce non-deductible debt over time. By strategically managing your finances and investments, you can potentially increase your net worth and achieve long-term financial security.

Steps in Implementing a Debt Recycling Strategy

- Evaluate your current financial situation and set clear goals.

- Identify suitable income-producing assets to invest in.

- Review your mortgage and consider refinancing options.

- Borrow against the equity in your property to acquire income-producing assets.

- Redirect the income generated from your investments towards debt repayment.

- Regularly monitor and review your strategy to ensure its effectiveness.

Key Components of a Successful Debt Recycling Plan

- Having a well-defined financial goal and timeline.

- Conducting thorough research and seeking professional advice.

- Maintaining a disciplined approach to budgeting and cash flow management.

- Regularly reviewing and adjusting your strategy as needed.

- Monitoring the performance of your investments and making informed decisions.

Successful debt recycling requires a comprehensive understanding of your financial position, risk tolerance, and investment objectives. It is essential to conduct a detailed analysis of potential income-producing assets and consider factors such as market trends, interest rates, and tax implications. By staying informed and proactive in your approach, you can maximize the benefits of debt recycling and work towards achieving your financial goals.

The Financial Implications of Debt Recycling

Potential Risks and Rewards

Debt recycling comes with both potential risks and rewards. On one hand, it can accelerate the repayment of your non-tax-deductible debt and build a portfolio of income-producing assets. On the other hand, there are risks associated with leveraging your assets and investing in volatile markets. It’s essential to carefully assess and manage these risks to ensure a balanced approach.

One of the key rewards of debt recycling is the potential to take advantage of tax benefits. By strategically structuring your investments and loans, you may be able to claim tax deductions on the interest paid on the investment loan. This can result in significant savings over time and boost your overall financial position.

Long-term Financial Impact of Debt Recycling

By successfully implementing a debt recycling strategy, you can significantly impact your long-term financial well-being. The ability to reduce your non-tax-deductible debt faster and build a diversified investment portfolio can lead to increased wealth accumulation and financial freedom.

Furthermore, debt recycling can provide a valuable opportunity to optimize your investment returns. By leveraging your existing assets to acquire income-producing investments, you have the potential to generate additional sources of passive income. This can create a snowball effect, where your investments grow over time, further enhancing your financial stability and future prospects.

The Role of Financial Discipline in Debt Recycling

Maintaining a Budget While Implementing a Debt Recycling Strategy

Financial discipline is crucial when implementing a debt recycling strategy. While redirecting cash flows towards debt repayment and investments, it’s important to maintain a budget that aligns with your financial goals. By tracking and controlling your expenses, you can ensure that you stay on track and achieve your wealth creation objectives.

One effective way to maintain financial discipline is to create different categories in your budget for essential expenses, discretionary spending, debt repayments, and investments. This level of detail allows you to see exactly where your money is going and identify areas where you can cut back or reallocate funds. Additionally, setting specific financial goals within each category can help you stay motivated and focused on your long-term objectives.

The Importance of Regular Financial Reviews

Regular financial reviews are an integral part of a successful debt recycling strategy. By reviewing your performance, adjusting your plan, and staying informed about market conditions, you can optimize your strategy for the best possible outcomes. These reviews will allow you to make informed decisions and ensure that your financial journey remains on track.

During financial reviews, it’s essential to not only look at your current financial situation but also to reassess your short-term and long-term goals. Circumstances may change, and it’s important to adjust your strategy accordingly. By staying proactive and regularly evaluating your progress, you can make strategic decisions that will help you achieve financial stability and growth.

Navigating Legal and Tax Implications of Debt Recycling

Understanding Tax Benefits and Obligations

When implementing a debt recycling strategy, it’s essential to consider the tax implications and obligations. Consult a tax professional to understand the potential tax benefits and ensure compliance with relevant tax laws and regulations. By leveraging the tax advantages associated with debt recycling, you can optimize your wealth creation strategy.

One key aspect to consider is the difference between deductible and non-deductible debt. Understanding how each type of debt impacts your tax position is crucial in maximizing the benefits of debt recycling. Additionally, exploring tax-effective investment options can further enhance the overall tax efficiency of your strategy.

Legal Considerations in Debt Recycling

Debt recycling involves various legal aspects that require careful consideration. It’s important to work with a legal professional to ensure that your strategy aligns with legal requirements and that your investments are protected. This includes understanding loan structures, property ownership, and any legal agreements associated with your investments.

Furthermore, when engaging in debt recycling, it is vital to conduct thorough due diligence on the legal implications of restructuring your debts. This includes assessing the impact on asset protection, estate planning, and potential legal risks that may arise from the restructuring process. By proactively addressing these legal considerations, you can safeguard your financial interests and mitigate any legal challenges that may arise.

Other resources: A Closer Look at Debt Recycling Examples and Strategies for Success